Love Lane Lives

The history of sugar in Liverpool and the effects of the closure of the Tate & Lyle sugar refinery, Love Lane

A 2006 ESSAY written FOR MY GLOBAL CITY students.

Written by Ron Noon at 06:45 on Monday, March 01st 2021

In the last blog about the merger of Tate & Lyle on 27th February 1921 I emphasised the essentially contested nature of “history” and why studying history is decidedly “not about developing the memory at the expense of the intelligence”! There is always a subjective element that enters into the reading and writing of “histories” hence the importance of selection and interpretation. The Top down approach to history (a history of the British peoples with the majority of them left out) was being asserted by a certain knight of the realm in the late 1980s early 1990s in relation to the NATIONAL CURRICULUM. He raised a question about it in the House of “Commons” at Prime Ministers Question Time.

“Is my right honourable friend aware that there is considerable concern about the teaching of history in our schools today? Instead of teaching what are vaguely called themes why can we not go back to the Good old days when we learned dates by heart and learned the names of the kings and queens of England, and of our great statesmen and warriors and of our battles and of the glorious deeds of our past.” Sir John Stokes

“As usual my honourable friend is absolutely right. This is the subject of a very very vigorous debate as to what children should be taught in History. I agree with him. Most of us are expected to learn from experience of history, and we can’t do that unless we know it. They should know the great landmarks of British history and should be taught them at school. I agree totally with my honourable friend.” The Right Honourable Margaret Thatcher.

Dates are important and this “exchange” took place on the 29th of March 1990.

I have been keenly aware of supreme ironies ever since I asked my Ninny Molly O’Brien (a wonderful shawl wearing, snuff taking, endearingly loveable and feisty woman) what she thought of Winston Churchill. That “irony” I need to elaborate on in a later blog but the irony in relation to the exchanges above at PM Question Time 31 years ago is surely that this was a Tory Government deeply committed to ending nationalisation in industry promoting the nationalisation of history teaching!

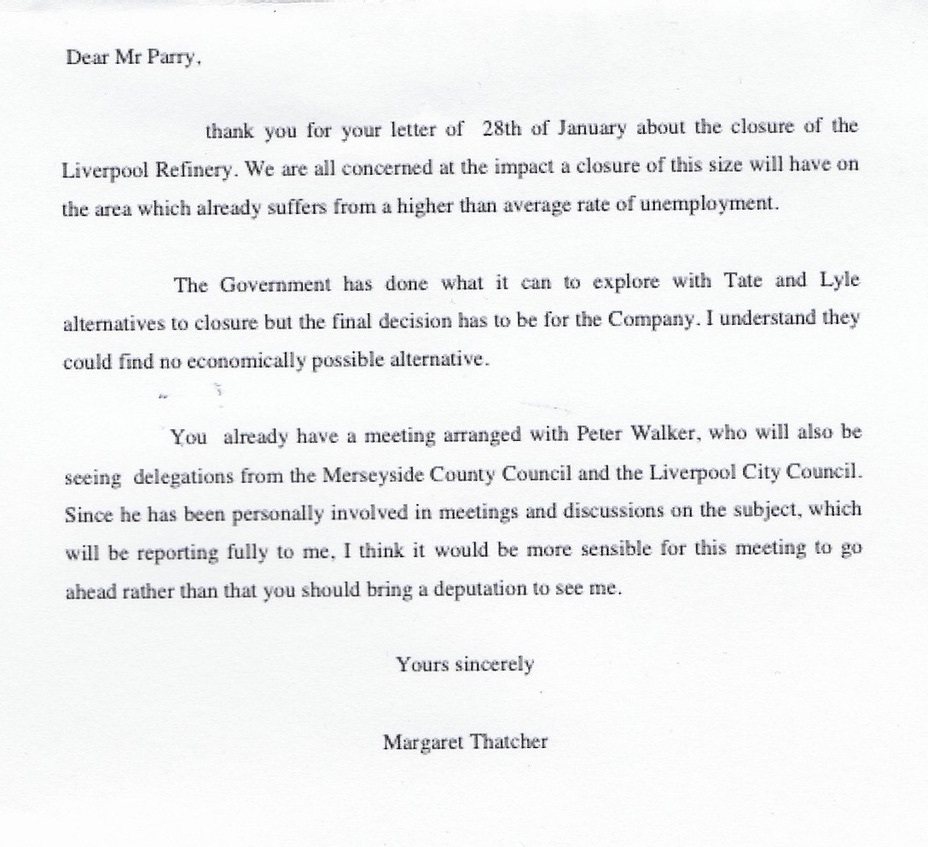

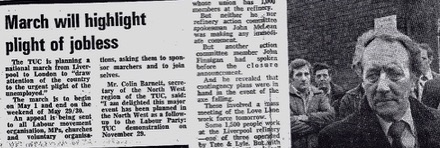

IN 1981 she had washed her hands of a Merseyside in Crisis, refusing to meet the delegates of the CONGRESS OF MERSEYSIDE seeking discussions to help avert the closure of LOVE LANE refinery and the result was disastrous.

Here’s more from a People’s History, a bottom up not top down version of the background to all this.

THE LEAVING OF LIVERPOOL

In 1981 an act of matricide was perpetrated when Tate & Lyle’s oldest and comically misnamed Love Lane sugar cane refinery was junked. The internecine sugar wars between beet and cane sparked off by British entry into the EEC appeared to have been the main cause of this and throughout the 1970s the amount of refining capacity was far in excess of the amount of raw cane allowed into the country under the new arrangements. A valiant ten year struggle by the Workers Action Committee, local MPs and church leaders, to keep open this prominent Liverpool landmark ended in defeat when the refinery officially closed on the 22nd of April 1981. For over a century the refinery had dominated physically and economically the Vauxhall and Scotland road communities, just north of the city centre. The other port refineries that purged and processed the raw cane imported by Tates from largely African, Caribbean and Pacific countries, were in Silvertown London, and Greenock Scotland. Despite the general problems facing the industry they were regarded by Tates management as more economically viable than Love Lane.

In 1976 five years after the first rumours of closure leaked out, it was obvious that the greatest disadvantage in closing Love Lane would be social not economic. “The loss of 2,000 jobs near the city centre would be more than the end of a business enterprise - it would obliterate community.” That widespread view, expressed by the Liverpool Daily Post on its Business pages, failed however to influence Tate’s management decision making. Paying lip service to it did, and “imposed” plant “rationalisations” followed by the introduction of 12 hour shifts, brought the labour force down to just under 1600 by 1981. The fact that the British government was vigorously opposed to belated EEC proposals in 1980 to reduce beet quotas was ominous for Love Lane. Now the tidy arithmetic of overcapacity in the port refineries, (300,000 tonnes was almost exactly what Love Lane was then producing), was exacerbated by a British Sugar Corporation, hitherto hampered by the weather and poor crop returns, now reaching record output figures and squeezing sugar cane outlets even tighter. Given the much greater refining margin afforded sugar beet, Tates could not win in any price wars. What ensued was an increasingly aggressive market share exercise by BSC, undercutting Tates, especially with larger buyers such as supermarkets. An Economist magazine article estimated the refining margin advantage of beet over cane at £20 per tonne. That was in the month that the closure of Love Lane was announced

Entry into the EEC and the Government’s signal failure to negotiate an adequate refining margin for partially processed raw cane, had been a persistent handicap. Previously it had been the UK Treasury but now it was Brussels that fixed the refining margin at a much higher level for the raw beet grower and refiner. Beet imports and increased production from BSC compounded these difficulties. The problems of joining the EEC and securing supplies hitherto easily catered for under the Commonwealth Sugar Agreement, had been dramatically overshadowed by the great sugar shortage and crisis of 1974 when prices went through the roof. Poor crops in the USSR in 1971 and then Cuba in 1972 meant the former buying increased quantities from the “free market” to meet its own requirements. World stocks were reduced and steeply rising prices and feverish speculative activity “brought chaos to the market, especially the special (preferential) arrangements”. Prices reached a short lived peak of £650 a tonne when even garages used sugar to lure “sweet toothed” motorists to their pumps. Inevitably consumption would level off and the premium on autarky and increasing production was primed by these extraordinary prices of 1974-75.

Autarkic means the pronounced desire for self sufficiency (we discussed this a couple of weeks back when we reviewed the Economist article from 1937!) and as Tony Hannah pointed out “sugar is one of the most autarkic of soft commodities”. The situation today is that “among countries with a significant capability of agricultural production, only New Zealand, Norway and the Republic of Korea are not producers of some quantity of sugar”. In 1974-1975 this resulted in a panic overreaction amongst governments, which unmistakably contributed to a number of negative long term consequences including not just a boost to the developing High Fructose Corn Syrup (HFCS) industries in America and Japan, but also the conviction that the world sugar economy was entering into a phase of permanent deficit. Increased support prices in the EEC and innumerable expansion programmes elsewhere lay the seeds of oversupply and plunging prices, soon after.

The beet lobby interest, so strong in Europe and particularly in France, trenchantly insisted on a massive expansion, which the commissioners willingly agreed to. They did so by increasing the tonnage which each country could grow, and as suggested above the raising of support prices. In Britain a Government White paper published in 1975, “Food from our own Resources”, gave BSC the green light to expand and to complete the processing of raw sugar in its own sugar beet factories by building on more “white ends”. The construction of white end capacity, meant that the refining and granulating of raw sugars which BSC had previously sent to Tates was now increasingly done “in house”. That erosion and eventual loss of supplies of raw sugar, compounded the problem of overcapacity in cane sugar refineries like Liverpool which historically had handled both cane and beet supplies. Another cruelly ironic fact was that once the panic of 1974/75 died down, Europeans were actually found to be eating much less sugar. That contraction in demand and the search for other sweeteners such as High Fructose Corn Syrup, (HFCS) was to take place alongside the building up of a “costly and embarrassing sugar mountain”. So when BSC eventually started to reach its generous EEC quotas in the late 70s the threat to the jobs of those in the cane sugar Port Refineries was acute.

The Death of the Tate & Lyle company spirit in the era of “Mad C.A.P.” disease

A leader article in the Economist at the time of the Liverpool closure announcement in January 1981 spotlighted “the problems created, because the European Economic Community has rejected the economics of comparative advantage in agriculture”. The World Development Movement, (WDM) had used another important economic argument eight years earlier, by warning that “if production costs are compared…not in terms of money but by looking at what the land and labour in each country could produce if they were put to their most profitable other uses…then beet production, because of the far greater opportunities available to resources in rich countries is substantially more costly”. The “opportunity cost” was considerable and the EEC’s sugar policy meant that sugar beet producers were paid nearly three times the world sugar price in the late 70s, which inevitably encouraged them to overproduce.

This global misallocation of resources was compounded by the further misuse of EEC taxpayers money then used to subsidise the export of these huge surpluses. “Dumping” them onto the “free” world sugar market had a disproportionately deflationary effect on the prices which third world countries were so much more dependent on, than in the protected and regulated markets of Europe and North America. The conclusion is inescapable. “The EEC’s Sugar regime is fundamentally contradictory in the way in which it relates to the developing country cane producers. On the one hand it gives preferential trade to a handful of countries under the Sugar Protocol of the Lome Convention. On the other hand, in failing to exercise restraint over its own production of sugar beet, it has contributed directly to chronically low world market prices for sugar which have led to considerable hardship for many Third World Producers.”

Merseyside by the early eighties was suffering a similar if obviously milder version of the damage to Third World sugar cane countries caused by the economic madness of the EECs Common Agricultural Policy. Accelerated job losses in other sectors of employment in the late 70s had suggested that the “Bermuda Triangle of British Capitalism” was in Merseyside. So tragically the city which had been renowned internationally in the 1960s for the sound of the Mersey Beat and the Beatles, was by the early 1980s, ostensibly Britain’s first internal “Third world” victim of the sugar beet. The EEC was however only one factor in the decline of Love Lane, a factor nonetheless which was skilfully and cynically magnified by management, to divert attention from their own reasons for wanting rid of the mother plant.

The skill and the cynicism was not necessarily that of local management, but the local roots of this Sugar Giant meant that the parent company were able to project a company spirit very different to that of the other MNCs grafted onto the local economy post 1945. Phillipe Chalmin described the birth of that remarkable “company spirit” in the inter-war years. “On the whole the working conditions did not stand out against the norm.. were it not for the constant promotion of a ‘family-like company spirit’ (supported by numerous social and sporting activities encouraged among Tate & Lyle’s employees). On the long term this policy paid off, securing for the company the loyalty of many an employee…Tate & Lyle thus evolved. ..towards the most typical form of paternalism.” Generations of Tates employees, were very effectively “socialised” into accepting, relatively uncritically this perception of a soulful and paternalistic company. “It was a good company to work for” was the constant refrain of so many of its employees.

Arguably in Liverpool where casualism and insecurity were endemic, that feeling was even stronger. The recruitment policy of the old Tates had been that children followed parents into the employ of the company and “parallel to the Tate & Lyle dynasties, dynasties of employees emerged and sometimes three generations would be working at the same time for Tate & Lyle”. That selective recruitment policy aside, the firm’s ability to contrive and sustain the image of paternalism was achieved with very little expenditure in terms of actual effort. Indeed the culture of opposition that manifested itself amongst other groups of Liverpool workers in that era of company closures and rationalisations, did not manifest itself at Love Lane and its long established local roots meant that Tates effectively were able to project a company ethos very different to that of the other Multi-nationals that had operated branch plants on Merseyside post 1945. Down to the mid 1970s especially, it was an impressive and effective piece of local theatre.

Long service employment meant that in the 70s while the company was clearly not recruiting labour of all ages the consequence was “a seriously ageing labour force”. The Vauxhall Community Development Project surveyed the age structure at the plant in 1973 and noted that over half were aged 45 years or more “and now each year a couple of hundred of the total labour force are presented with their long service retirement clock”. The most significant effect of rationalisations and job cuts was irreparable damage to the local community. This euphemistically named natural wastage was “another word for redundancy by proxy”. It meant that “you won’t be thrown out of work, but it means that your child or your neighbour, or your neighbour’s neighbour, won’t get a job when he wants one. And since job movement is something of a chain reaction it means that your own job chances will be that much slimmer at the end of the chain.”

The VCDP reported a typical example: “My father worked here for forty four years. He retired when he was 58 with bronchitis, and died when he was 60. The furthest he ever went was to bed because he was tired, it was so hard here. You know we were born and bred for Tate’s.” Job prospects for older workers whose expertise and experience was very particular to sugar refining were very gloomy. Through family and home commitments they had less propensity to move elsewhere in search of work, and long term unemployment was the sickening reality for so many “sweet fighters” like Albert E Sloane. One of the sweeteners on the company pill of rationalisation was the offer to create new work in related though diversified new products, including even proposals for a sugar based detergent factory. The workers action committee on the basis of “half a loaf is better than none” were prepared to go along with job cuts as long as some form of presence was kept on the historic site. For a time it seemed as though a “job for job” policy was being pursued, but when TALRES (Tate & Lyle Research) went into partnership with an American chemical company to build a detergent plant it was on a green field site eight miles away from Love Lane.

Those stark facts made it all the more nauseating to reflect back on the warmly persuasive references that were so often made about “Tate’s”, the local firm that for over 100 years had been well known for job security and paternalism. At one time no doubt it had reflected pride and perhaps the knowledge that Love Lane had been set up by the dynamic entrepreneur and former grocer Henry Tate in 1872, six years before he decided to build Silvertown in South London. The mother plant had been built on what had been a “des res” site where rich merchants once lived, and where their wives and daughters had perambulated along the “charmingly named Love Lane, Ladies Walk and Maidens’ Green”, glimpsing as they did eye catching views of the river. This rural idyll coincided with the opprobrious trade in human cargo that George Cooke railed against, but pre-dated the construction of the Leeds Liverpool canal and the general processes of industrialisation and urbanisation which transformed the enchanting landscape of Love Lane into coal yards, brick fields and glue factories. During the nineteenth century a political essayist was to unintentionally emphasise the obstacles to “gender solidarity” when he referred to middle class “ladies” and “mere biological females”. By 1870 the residential requirements of the Victorian middle class and their daughters had changed more dramatically than that of their working class sisters. The former habitat of ladies was left with only the charming name which a 100 years later was thought to have been dreamed up by someone on the popular TV show, “The Comedians”!

“You have no idea how massive Love Lane refinery was. It was a city on its own. Huge and like Topsy it had just growd over a hundred years.” That was the pertinent description provided by John Maclean, a former maintenance fitter, popular scribe, and secretary of both the Love Lane workers action committee, and the national Port Refineries Committee. Another former Tates employee, J A Watson, a company chemist and historian of the family, represented its scale and magnitude in this way. “For 109 years travellers approaching Liverpool by train from the North, knew they were near when they passed the refinery with its prominent sign: firstly Henry Tate & Sons and then Tate & Lyle Ltd. Soon however the refinery and its sign will be gone: just another seemingly permanent landmark that has vanished.”

The local firm had clearly exported its success elsewhere, and despite claims that its real heart would always continue to beat in Love Lane, by 1981 this was the most expendable plant. The destruction of the original site used by Love Lane ladies was of far less consequence than the demise of the “blue turbaned” biological females from Chisenhale, Eldon and Burly streets who had been employed in the packing sections of the refinery. Renowned for their famous headgear and distinctive trousered uniform, their “perambulations” around the packin’ and over “the bridge on the River Kwai”, (the canal separated the male process workers from the predominantly female packers), was of course historically much more significant in the collective memory of the blighted community. So you can close a city down. The destruction of that Liverpool landmark and the hole it left in the community, graphically illustrated what a prescient nineteenth century political economist and contemporary of Henry Tate, had consistently warned about. “All that’s solid eventually melts into air.”

From ‘bone char’ to Portfolio consciousness

Subjective and objective realities are often in “disagreement” and it was increasingly apparent to informed observers in the 1970s that a new chapter in Tates’ history had opened up long before the history of sugar refining in Liverpool came to an end. Symptomatic of this was the appointment of outsiders to key positions in the firm. In 1978 Lord Jellicoe took over from John Lyle to become the first Chairman appointed from outside the families. This was a trend which had been discernible for some time however. Where once pride and pragmatism had dictated that executives should all go through the “sugar mill” so as to familiarise themselves with the firm’s essential “core” refinery activities, a new breed of professionals and accountants without “bone char” in their “blood” were looking elsewhere to exploit markets and opportunities in services and trading.

Diversification out of sugar refining in the UK was a strategy Tates had planned and prepared for years before Britain joined the EEC in 1973. From the early 1960s a number of directors realised that refining was no longer the “cash cow” it had once been. Despite opposition from some of the old guard “sugar mill” directors, the acquisition in 1965 of United Molasses, with its world wide network of activities and distribution points, opened up new horizons and new directions. It also completed another symbolic “local/global” dimension because UM had been founded by a “Liverpool Dane” with an attraction to molasses, Michael Kroyer Kielberg. He had arrived in Liverpool in 1907 at the age of 25 as “a quiet soberly dressed young Dane…about to apply for a job with a modest firm of cattle-feed importers”. The firm not only took him on but within three years made him a partner. “Now Kielberg became fascinated by molasses” and a global dynasty was formed.

The movement away from the increasingly anachronistic image of Tate’s as an “imperial sugar company” was accelerated by this new venture. The policy of vertical integration along the sugar chain and the acquisition of sugar plantations in Jamaica and Trinidad had been a successful response back in the 1930s to increasing autarky in world trade and stifled opportunities in the home market. “The firm was more a ‘last comer’ than a first mover in its decision to invest in plantations…The company, which was Britain’s leading sugar refiner, had tried to invest in the emergent British beet sugar industry, but had been forced out by the emergence of a quasi-state monopoly. The initial investments in the West Indies were motivated by the desire to employ resources released from the unsuccessful beet sugar venture.” Thirty years later the sugar and real world had moved on and dismantling the imperialist legacy was not only economically but clearly politically opportune for Tates. This move from direct plantation production and “tradition” was a clear recognition that the UM flag was the banner for the future.

The historic by-product of sugar production, used by the fermentation and livestock feed industries was molasses and UM was the world leader. Molasses is the dark treacly stuff left over when it is no longer economic to extract sugar from cane or sugar beet. To the aficionado the essential difference between the cane and the beet was that “rumbullion” or “rum” can only be produced satisfactorily from molasses extracted from the tropical plant! Furthermore unrefined cane molasses contains some important minerals such as iron, zinc, chromium, and small quantities of magnesium, calcium and potassium. This is not enough to fill the “empty calorie” but certainly enough to differentiate it from that extracted from beet. UM was much more than just rum and “brown sugar”. The extensive storage, loading and unloading equipment, spread over a vast geographical area, meant that the international molasses economy was dominated by a few players. Not many could afford to operate on such a scale. UM certainly did and was also an international trading firm with its own shipping lines. When Tates took it over the organisation effectively metamorphosed to become ‘a real multi-national’.

Changing commercial and economic realities meant that throughout the 1970s Tates was spreading its tentacles much further a-field, along and even outside the sugar chain. Amusingly this included an ill timed, ill judged venture into manufacturing skateboards in 1977! Generally though, it exploited, trading, shipping, consultancy, engineering and research know-how, and operated much more, as Phillipe Chalmin argues, like a “multi-national of the tertiary sector”. Given that the best years for “the heavy economy” of refining appeared to be over, there was clearly an added incentive to develop trading, consultancy and services without spelling out precisely its implications for Tates’ oldest refinery site. The process of paring down the heavy economy at home would severely test and ultimately find wanting the Tate & Lyle company spirit. Nevertheless even when the Port of Liverpool was being rapidly run down and rationalisations were eliminating jobs in adjacent inner city areas, the notion of “a job for life” with Tates was still part of the collective folklore.

An in-house brochure published in 1977 described the organisation as a specialist in trading and service areas. “Tate & Lyle’s mission is to develop a complete commodity processing, trading and handling service, to meet its own needs and those of third parties.” Indeed more money was actually made in the 70s from the ability of Tate & Lyle’s traders than on “the classical industrial margins”. As Hannah Wright pointed out “if a player not only trades in sugar, but also grows it, ships it and refines it, then his prospects in the game are considerably enhanced”. To that extent the adverse consequences of EEC entry for sugar cane refineries, has to be related to the logic of these wider adjustments and new directions. The often intense “politicking” around EEC questions and the related sugar diplomacy clearly posed a challenge to Tates but never at any time did it seriously portend a mortal blow to its newer profit centres. Despite a denial that “transfer pricing” was practised within the group they certainly “practised a very sophisticated fiscal policy”. Down to 1976 when trading was reorganised and “Albion Ltd” was dissolved, “profits made by the Bermuda subsidiary” of the Canadian subsidiary Redpath, “were reinvested to buy ships rented to a British subsidiary”! They were also clearly able to use the complexities of European politics and sugar diplomacy to camouflage their real strategic intent and interests.

Tate & Lyle PLc: The “soulless global corporation”

“Tate & Lyle was a multinational before the word was invented.”

The appointment of Lord Jellicoe in 1978 as Chief Executive, was very much at the expense of Saxon Tate, the “family” man who had been expected to take control when John Lyle stood down as Chairman. Jellicoe was an outsider who had only been on the board for four years whereas Saxon Tate had served a long and profitable apprenticeship with the Canadian subsidiary Redpath Sugars. From 1972 he had “for all intents and purposes” run the Tate & Lyle group. The introduction of modern methods of management and “the first touch of professionalism from within the board” was directly attributed to his regime. Consequently the consolation job of Group Managing Director, albeit under a son of the “victor” of the naval battle of Jutland, seemed scant reward for such endeavours. The fates seemed to be conspiring against Saxon Tate when in June 1980 he was given the honorary post of Vice Chairman. It was a poignant moment when his executive functions were all stripped away. An even crueller irony was to follow, with the appointment of the Canadian, Neil Shaw as Group Managing Director. This was clearly a reminder if one were still needed that a new day had indeed dawned for the sugar multi-national.

The first time Shaw had taken over from Saxon Tate was at Redpath when both their stars were in the ascendant, but the former subaltern now overshadowed not only the old Etonian, Oxbridge educated, former Life Guards officer, but also the “family spirit” as well. Along with Saxon Tate, the ideological baggage of tradition and paternalism was rapidly shunted to the sidelines. The following year Lord Jellicoe, as Chairman of a Board of Directors “on which there was, symbolically, neither a Tate nor a Lyle”, made the announcement that Love Lane was to close. “Thus the history of sugar refining in Liverpool was to come to an end at the beginning of 1981, after over 150 years of ‘good and loyal services’, owing to the ‘treachery’ committed by a firm which had been born there a little over a century earlier.”

Increasingly global perspectives meant that there was a corresponding withering away of national or local roots or loyalties. Much of that was evident before Neil Shaw took over as Group Managing Director, but under him the metamorphosis from what Chalmin describes as a “family and moral community” into a financial community was completed. Shaw had first been appointed to the Board in 1975 but by the mid 1980s he would assume an unprecedented position of power as the company’s first ever Chairman and Chief Executive. Some argue that it would be more accurate to describe Tates as an embryonic “supra-national” corporation where arguably “the nation of the corporate headquarters, let alone the towns where corporate production is based is of declining significance”. This concept of the rootless firm without national identity, searching the world for low wages and union free environments is not without some substance but most multi-nationals are still locked by culture, tradition and staff into one nationality. The British based Tate and Lyle has witnessed a number of organisational shifts over the last thirty years which have severely compromised its historic “paternalistic” image. The end of sugar cane time in Liverpool and the blighting of an inner city community was the most dramatic consequence of that change, and was emblematic of the “soulless global corporation” that Henry Tate, the entrepreneur and philanthropist had unintentionally bequeathed to the world.

Have a look at my Love Lane Refinery Lives essay in NWLH journal September 2007

P.S. If you’ve shown such great patience and stamina to get right down to here, that was the nudge to the students on GLOBAL CITY.