Love Lane Lives

The history of sugar in Liverpool and the effects of the closure of the Tate & Lyle sugar refinery, Love Lane

Tate & Lyle, one time Imperial Sugar Giant sings “Bye, Bye Sugar, Bye Bye”!

Written by Ron Noon at 21:41 on Thursday, July 01st 2010

The opening comment on our Love Lane Lives film is from a woman who declared shortly after the refinery closure in April 1981, “it’s dead now”! She meant Liverpool was dead, not Tate & Lyle but I wonder what she might have said about today’s historic announcement from Tate’s London Sugar Quay headquarters, that the once biggest sugar processor in the world, is literally selling off its sugar business? It will be left with “splendid” Splenda, the low calorie sweetener made from sucralose, and a substantial ethanol and industrial food ingredients business, which CEO Javed Ahmed emphasised as accounting for the majority of its annual sales and profit. If we had some ghostly interviewing techniques what would Henry Tate and Abraham Lyle make of a new company diet bearing their illustrious names but premised on eliminating sugar cubes and golden syrup?

In popular parlance Tate’s sugar cubes and Lyle’s golden syrup have gone together like bangers and mash but the newly appointed CEO who took over from Iain Fergusson at the end of last year has clearly decided to break away from company traditions and popular perceptions of its brand image. He does not see “Value added” in the sugar refining industry, the brand with which Tate & Lyle is synonomous, but which historically has always been associated with the volatility of the commodity business.

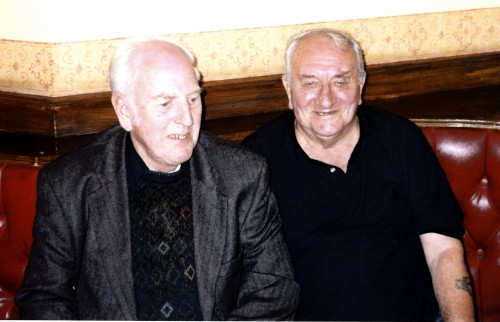

I rapidly realised after I’d made a start to my research and talked to Albert and John about the progress I was making, that Tate & Lyle was not only strategically disinvesting from its once core sugar refining activities but pursuing investments wherever there was profit to be made which in 1977 they disastrously thought was in projects like skateboards! By 1988 when Tates had moved into High Fructose Corn Syrup, (HFCS) and invested in the American and European sweetener and starch industry using corn or wheat based products for the soft drinks, food and packaging industries, the influence of the commodity sugar business within the group declined even more. (Previous blogs refer to Tate’s main American acquisition, AE Staley and what Matt Damon’s role in THE INFORMANT dramatises in relation to the politics of corn sweeteners!) That said it would have been a sheer feat of imagination to have envisaged a Tate & Lyle world entirely devoid of sugar. That’s what today’s announcement symbolises for a transnational company long stripped of its ethnicity and family spirit. For our Love Lane Lives project however and for the Liverpool school children of Trinity and Hillside, the achingly addictive study of the bitter sweet world of sugar and it’s local and global lessons, continues unabated.

Here’s the news from REUTERS:Published: July 1, 2010

“LONDON — Tate & Lyle sold its European sugar operations to American Sugar Refining for £211 million Thursday, breaking a 150-year link to sugar in favor of low-calorie sweeteners offering faster growth. The privately owned U.S. group is buying Tate’s sugar and Golden Syrup business for the equivalent of $315 million, with a perpetual license to use the Tate & Lyle name. Tate said it will focus on its sweeteners such as Splenda and its industrial starches.

The British sugar maker’s roots go back to 1859 when Henry Tate started refining, then introduced the sugar cube to Britain in 1875. His legacy lives on after he bequeathed his paintings to form the nucleus of London’s Tate Britain gallery.

Tate’s new chief executive Javed Ahmed sparked talk of a sale of its underperforming sugar operations in May when he promised to focus on its super sweetener Splenda and corn-based sweeteners and starches largely made in the United States. .

Tate shares were up 2.7 percent to 462.1 pence at midday.

“We see the move as positive as it offers a cash injection and a move away from commoditized businesses,” said analyst Dirk Van Vlaanderen at Jefferies International.”

..................................................................................................................................................................................................................................................

The increase in share price suggested it was a sweet deal for Tates but share prices also increased in 1981 when Sugar Cane Time came to an end in Liverpool.

.......................................................................................................................................................................................................................................

Here’s the actual press release from Tate & Lyle on their website: 01 Jul 2010 07:00

TATE & LYLE TAKES MAJOR STEP TO FOCUS BUSINESS THROUGH SALE OF EU SUGAR OPERATIONS

Tate & Lyle PLC (“Tate & Lyle”) announces today it has signed an agreement for the sale of its EU Sugar Refining operations (“EUS”) to American Sugar Refining, Inc. The consideration is £211 million payable in cash, subject to closing adjustments for net cash and working capital, with the proceeds used to reduce Tate & Lyle’s net debt1.

On 27 May 2010, Tate & Lyle announced its clear intentions to focus, fix and grow its business. Today’s announcement is fully consistent with those intentions and will result in a more focused, less volatile business, and a solid platform to deliver sustainable long-term growth in Speciality Food Ingredients, supported by cash generated from Bulk Ingredients.

EUS consists of the cane sugar refineries in London, UK, and Lisbon, Portugal, the Lyle’s Golden Syrup factory in London, UK, the associated sugar and syrup brands and the Tate & Lyle Process Technology consulting business. In the year ended 31 March 2010, these businesses had external sales of £689 million and made an adjusted operating profit of £14 million (after transitional aid of £17 million), and had gross assets of £374 million at 31 March 2010. The sale excludes historic UK pension assets and liabilities and is expected to give rise to a book loss on disposal, before costs, of approximately £55 million, subject to exchange rate movements and the timing of completion. The transaction is expected to be neutral to the Group’s adjusted earnings per share on total operations in the 2011 financial year.

The completion of the transaction, which is conditional upon anti-trust clearance in Portugal, is expected to occur in approximately two months. Payment of £5 million of the consideration is contingent on the transfer of certain joint venture shareholdings that are subject to pre-emption rights held by the other shareholders.

Tate & Lyle has provided American Sugar Refining, Inc. with a perpetual worldwide licence to use the Tate & Lyle brand in connection with the retail sale of sugar and in other limited circumstances.

Tate & Lyle also announces the launch of processes to sell the remaining businesses within the Sugars division, principally Molasses and Vietnamese sugar.

The Sugars division will be classified as discontinued in the Interim Results to 30 September 2010.

Javed Ahmed, Chief Executive of Tate & Lyle said:

“Sugar refining has enjoyed a long and proud history within Tate & Lyle, but we believe the interests of this business and its employees are now best served by being part of a company for whom sugar refining is core. I sincerely thank our employees for their hard work and commitment over the years, and wish them every success in the future.

“Tate & Lyle’s clear priority is to grow its Speciality Food Ingredients business, supported by cash generated from Bulk Ingredients. This disposal will enable us to concentrate our resources on delivering our strategic objectives as we focus, fix and grow our business.”

........................................................................................................................................................................................................................................................................

P.S. American Sugar Refining Inc. is buying Tate’s sugar business and “perpetual license to use the Tate & Lyle name”. This is the new Sugar Giant on the block, owned by Flo.Sun Inc down in Florida, a private company which in turn is owned by Cuban Americans Alfy and Pepi Fanjul! (They bought Domino Sugar from Tate & Lyle in 2001 and Tate & Lyle Canada Ltd. (Redpath Sugar) in 2007, so there is a definite familiarity and “kinship” between the old and the new kids on the sweetener block.) For Father Christopher Hartley though, so keenly aware of the power of the Fanjuls and the “price of sugar” from the Dominican Republic, the focus on the sugar world also remains unabated.

PPS. Will the sage and up to the minute MWW from the Wirral please let me have his email address and identity next time he leaves a comment on the site?